Unlocking Innovation: How R&D Tax Credits Fuel Business Growth

22 March 2024

Innovation isn’t just a buzzword; it’s the lifeblood of businesses striving to stay competitive in today’s dynamic market landscape. However, bringing innovative ideas to commercialisation often requires significant investment, both in terms of time and resources. This is where Research and Development (R&D) Tax Credits come into play, acting as a powerful financial tool for driving business growth through innovation.

Advancing Innovation Through R&D Tax Credits

R&D Tax Credits are a government incentive designed to encourage companies to invest in research and development activities. In Ireland, this incentive offers generous tax relief to companies engaged in qualifying R&D projects, providing a much-needed financial boost to fuel innovation.

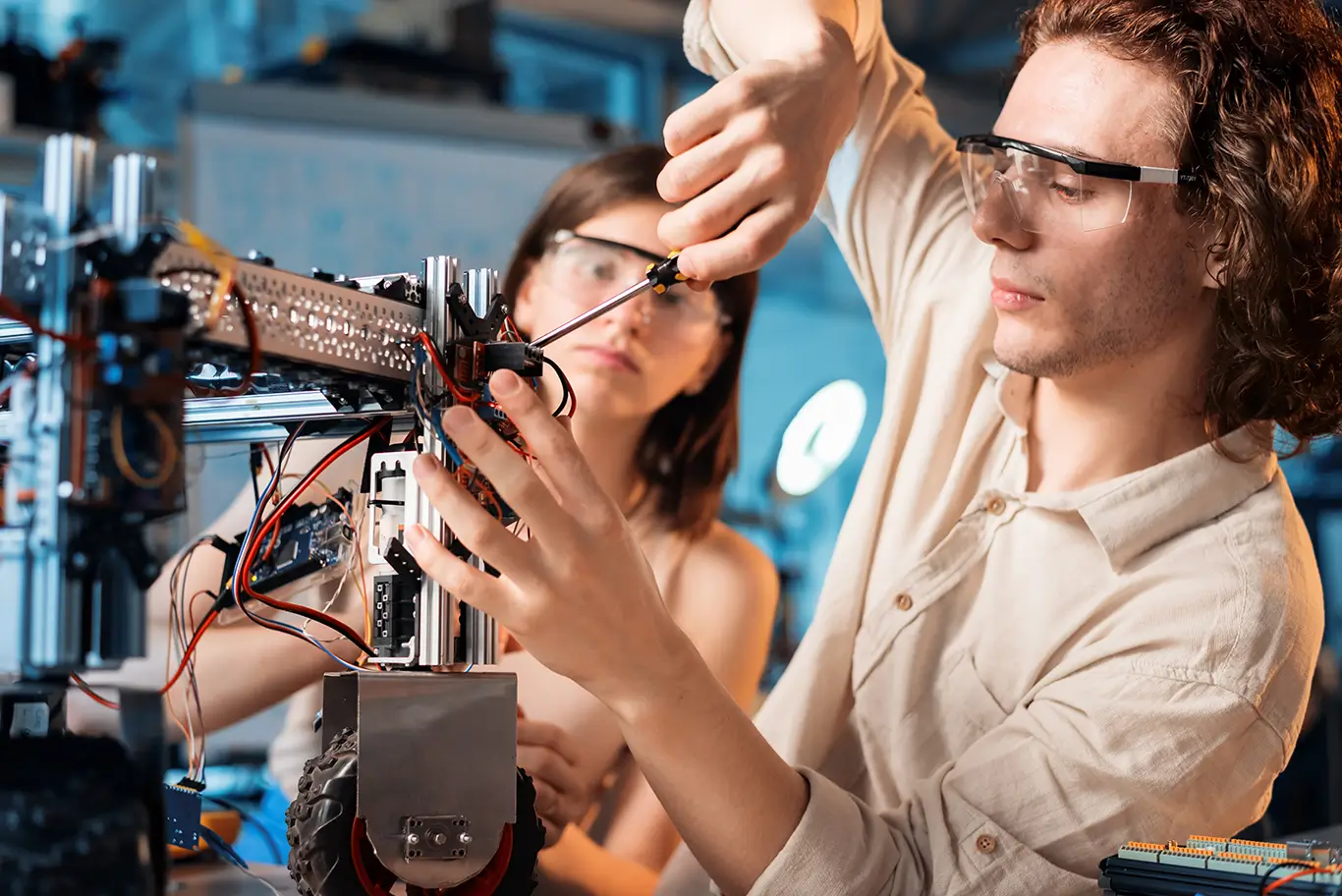

Whether it’s developing new products, improving existing processes, or conducting groundbreaking research, R&D projects often come with hefty expenses. From hiring specialised talent to purchasing cutting-edge equipment, the costs can quickly add up, making innovation seem out of reach for many cash poor businesses.

However, with R&D Tax Credits, companies can recoup a significant portion of their R&D expenditures through tax relief or cash refunds. This financial support not only encourages companies to embark on ambitious R&D projects but also enables them to allocate more resources to innovation without jeopardising their bottom line. As a result, businesses can pursue riskier, more ambitious projects that have the potential to drive substantial growth and transformation.

Empowering Businesses to Take Calculated Risks

Innovation inherently involves taking risks. Whether it’s exploring uncharted territories or experimenting with unconventional ideas, there’s always a degree of uncertainty associated with innovation. For many businesses, the fear of failure can be a significant deterrent, preventing them from fully embracing innovation and lagging behind the competition.

By offering financial incentives for R&D activities, companies get rewarded for their innovations, empowering them to take bold leaps forward with the knowledge that they will benefit from the scheme. This newfound confidence encourages companies to push the boundaries of what’s possible, leading to breakthrough discoveries, disruptive technologies, and game-changing innovations.

Driving Long-Term Economic Growth and Competitiveness

Beyond individual businesses, R&D Tax Credits play a crucial role in driving long-term economic growth and enhancing national competitiveness. By incentivising companies to invest in innovation, governments can stimulate economic activity, create high-skilled jobs, and foster a culture of entrepreneurship and creativity.

Moreover, by nurturing a vibrant ecosystem of innovation, Ireland can position itself as a global leader in emerging industries and technologies. This not only attracts foreign investment and talent but also strengthens the overall resilience and competitiveness of the economy.

In conclusion, R&D Tax Credits are much more than just a financial incentive; they are a catalyst for unlocking innovation and driving business growth. By providing businesses with the financial support and confidence needed to pursue ambitious R&D projects, R&D Tax Credits empower companies to innovate, compete, and thrive in an ever-evolving market landscape. As businesses continue to harness the power of R&D Tax Credits, the possibilities for innovation and growth are virtually limitless.

For more information on our services and how Visiativ Ireland can help your business, please get in touch and a representative will get back to you to discuss your unique needs and explain how we can assist.